What Debt Relief Option Might Be Appropriate For You

You might find yourself in a position where you are facing serious financial challenges. You might be unable to make your mortgage payments or you are not able to keep up with your payments on your credit cards, line of credit or student loans. Consumers have nine debt relief options for eliminating their debt, although there might be as few as one or two options which might be ideal for a consumer at any given time.

Many consumers make poor debt relief choices because they do not adequately understand their options including the advantages and disadvantages of each one. Consequently, many individuals have no idea which one or two options might be ideal for their particular debt situation.

How to choose the most appropriate debt relief option?

The purpose of this blog is to provide you with information—a decision-making process–so that you can identify which debt relief option or options might be your best choice at a particular time.

- What are the nine debt relief options available to consumers?

- What does my debt profile look like?

- Which debt relief options are available for my debt?

- Am I precluded from using any particular debt relief options?

- Of the debt relief options available to me, what are the major disadvantages of each option?

- Of the debt relief options available to me, what are the major advantages of each option?

- What are the ideal circumstances for using a particular debt relief option?

- Given my circumstances, of the debt relief options available to me, which are the most ideal?

- Are there any reasons why I might want to wait before I choose a particular option?

What are consumers’ nine debt relief options?

There are nine different options for eliminating debt, as follows:

- Raising money by selling some of your assets

- Borrowing money

- Making monthly payments to one or more creditors

- Credit Counselling

- Consumer Proposal

- Bankruptcy

- Debt Settlement

- Do Nothing (make no payments to selected creditors)

- Wait & See Approach

In the next few paragraphs I will summarize each of these nine debt relief options. It is important to note that it might be possible to use more than one of these options at the same time. Furthermore, it might be possible to employ a particular debt relief option or options for a period of time and at some future date to switch to a different debt relief option. In a number of circumstances the passage of time might be a consumer’s best friend. This is particularly true if a consumer wants to eliminate their student loans (can be discharged by bankruptcy where filing seven years after leaving school) or avoid paying an unsecured consumer debt altogether by relying upon the expiry of a limitation period.

In the next few paragraphs I will summarize each of these nine debt relief options. It is important to note that it might be possible to use more than one of these options at the same time. Furthermore, it might be possible to employ a particular debt relief option or options for a period of time and at some future date to switch to a different debt relief option. In a number of circumstances the passage of time might be a consumer’s best friend. This is particularly true if a consumer wants to eliminate their student loans (can be discharged by bankruptcy where filing seven years after leaving school) or avoid paying an unsecured consumer debt altogether by relying upon the expiry of a limitation period.

Raising money by selling some of your assets

You might find yourself in a position that you could resolve some, or all, of your outstanding debts if you were to sell some of your assets. These assets might include a boat, camper, snowmobile, motorcycle, car, or coin collection. You might be able to raise some money by selling your car and replacing it with a less expensive vehicle. Selling any real estate that you own—including a cottage, rental property, or the home, townhouse, or condominium where you live—has a number of advantages. Firstly, the sale of real estate should generate some cash which you can use to pay down your debts or to fund some kind of debt resolution strategy where you eliminate debt for less than 100 cents on the dollar. Secondly, if you don’t own any real estate in your own name you may discourage your creditor from suing you. Creditors like to sue people who own real estate because they can slap a lien on the property and wait for the property to be refinanced or sold at which time they will get paid out—with interest! Canadians should be very careful about cashing in their RRSPs to pay down their debt. Cashing in your RRSP will trigger income tax liability. Furthermore, Canadians who file for personal bankruptcy are able to keep their RRSPs except for any contributions made twelve months prior to bankruptcy.

Borrowing money

In some instances consumers will try and address their debt situation by borrowing money and using this money to either make payment in full or resolve one or more of their existing debts for less than 100 cents on the dollar. All too often eliminating consumer debt by resorting to borrowing money only causes the consumer to dig a bigger and deeper financial hole for himself. There are, however, circumstances where the cost of borrowing money is not prohibitive. It might be possible for a consumer to borrow money relatively inexpensively by obtaining a mortgage on their real estate or obtaining a loan from friends or family members.

In some instances consumers will try and address their debt situation by borrowing money and using this money to either make payment in full or resolve one or more of their existing debts for less than 100 cents on the dollar. All too often eliminating consumer debt by resorting to borrowing money only causes the consumer to dig a bigger and deeper financial hole for himself. There are, however, circumstances where the cost of borrowing money is not prohibitive. It might be possible for a consumer to borrow money relatively inexpensively by obtaining a mortgage on their real estate or obtaining a loan from friends or family members.

Making monthly payments to creditors

In certain circumstances, it might make sense for a consumer who owes monies to a particular creditor to make monthly payments. This can be an effective strategy if you owe money to the government. If you owe the Canada Revenue Agency $1,000 for income tax you might want to send them 12 post-dated cheques for $100 each, which taking into consideration interest and penalties, might be sufficient to pay off this indebtedness. In some circumstances it might make sense for you to make monthly payments to one or more unsecured creditors. If you have five credit cards and you cannot make the minimum monthly payments on all five cards it might make sense to keep current on one of your five cards.

Credit Counselling

Some consumers could repay their existing unsecured consumer debt if they were able to lower their monthly payments to creditors and receive additional time to pay. A consumer who wishes to eliminate their debt using credit counselling would enroll in a Debt Management Plan with a credit counselling agency. A consumer must include all of their unsecured consumer debt in a Debt Management Plan. Under a Debt Management Plan a consumer will repay one hundred percent of their indebtedness to the credit counselling agency by making monthly payments over a period not to exceed five years. Furthermore, credit counselling agencies typically charge a consumer enrolled in a Debt Management Plan an additional fee, equal to somewhere between five and fifteen percent of a consumer’s monthly payments. Once a consumer enrolls in a Debt Management Plan with a credit counselling agency then all collection activity will stop.

Consumer Proposal

Bankruptcy

In order to file for personal bankruptcy a consumer must meet with a Licensed Insolvency Trustee and complete a Statement of Affairs, a detailed list of the amounts owing to all of the consumer’s unsecured creditors. Under a bankruptcy the bankrupt must transfer all the bankrupt’s property to the Licensed Insolvency Trustee except for property which is exempt under federal or provincial law. RRSPs are exempt except for contributions made within 12 months of bankruptcy. Each province exempts certain property types of household property within a certain dollar amount, as well as certain items the bankrupt might own necessary to earn a living. If the bankrupt earns more than about $35,000 per year then they will have to make surplus income payments to the bankruptcy for 21 months, and longer if the bankrupt is not a first-time bankrupt. The larger the bankrupt’s salary, the greater the surplus income payments. Once a bankrupt receives their discharge then, subject to a few exceptions, all of their unsecured debts are forgiven. Debts which are not discharged in a bankruptcy include child support and spousal support obligations, court fines and court judgments involving fraud. Furthermore, student loans are not forgiven unless the bankrupt ceased attending school at least seven years prior to filing for bankruptcy. Once a consumer files for personal bankruptcy then all collection activity against the consumer will stop. Filing for personal bankruptcy does not provide a consumer with any relief in connection with the consumer’s secured debts.

Do Nothing

A consumer who uses the do nothing approach with respect to one or more debts does not make any payments to one or more of their creditors.

Wait-and-see Approach

The wait-and-see approach is a strategy for dealing with unsecured consumer debt, and to a lesser extent monies owing to the government. It involves postponing any decision with respect to enrollment in a Debt Management Plan with a credit counselling agency, making a consumer proposal, or filing for personal bankruptcy. With respect to your unsecured consumer debt, a consumer experiencing serious financial difficulties may have everything to gain and very little to lose by making a decision to stop making payments to some or all of their unsecured consumer creditors including credit cards and lines of credit. The consumer might be able to avoid paying a penny to these creditors due to the expiry of a limitation period, the fact that the consumer is never sued, or the fact that a creditor who does sue them cannot enforce its judgment and recover any monies from the consumer. The consumer who uses the wait-and-see approach can re-evaluate their position at a future date. The fact that a consumer is sued by one or more creditors may result in a consumer adjusting their strategy. For example, if a consumer owes a total of $50,000 in unsecured consumer debt to five different creditors and one creditor sues him for $10,000 the consumer might decide to either make a payment in full or negotiate a discounted settlement with the one creditor who has sued him. If all five creditors were to sue the consumer then the consumer might decide to make a consumer proposal. If the relevant limitation period expired on some or all of this $50,000 in debt then the consumer might choose not to pay any of these debts and be in a position to avoid paying a penny to his creditors.

What does your debt profile look like?

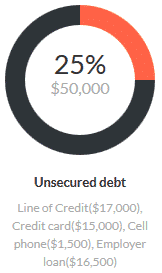

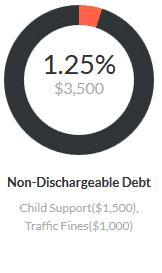

It is difficult to make an intelligent decision regarding how to deal with your debt situation unless you are able to create an accurate debt profile of not only the type of debt that you owe but also the amount of debt that you owe for each debt category. For the purposes of debt relief, there are four categories of debt, secured debt, unsecured debt, government debt, and non-dischargeable debt. Non-dischargeable debt is debt which can only be eliminated by making payment in full. This category includes child support, spousal support, court fines, and civil judgments involving fraud. These debts are not discharged or forgiven in a bankruptcy. Secured debt is debt in which your creditor has collateral in the event you fail to pay. The most common types of secured debt are mortgages and car loans. In addition, some personal loans are lines of credit are secured. Property taxes are secured debt because municipalities have a lien on real property for unpaid property taxes. As a general rule, any debt which is not secured debt is an unsecured debt. Most, but not all credit card debt, is unsecured debt. Monies owing to utilities, phone companies, internet service providers, and cable television firms are unsecured debt. Government debt includes income taxes, student loans, and H.S.T. It can be very helpful for you to list of all your debts, including the current amount owing on each individual debt, and assign it to one of these four debt categories, secured debt, unsecured debt, government debt, and non-dischargeable debt. An example will help illustrate this process. John Smith currently has $200,000 in total debt. His secured debts, totaling $140,000, include an outstanding mortgage and a car loan. He owes $50,000 in unsecured debt on a line of credit, two credit cards and $7,000 he owes on an employee loan, as well as $1,000 owed to a cell phone provider. He also owes $7,500 to the government, an amount which includes an outstanding student loan and some income taxes. He also owes $2,500 in non-dischargeable debt including amounts owing for traffic fines and child support arrears.

Debt Profile

John Smith

Total Debt: $200,000

Debt Relief Options Potentially Available By Debt Type

| Debt Relief Options | Secured Debt | Unsecured Debt | Government Debt | Non-Dischargeable Debt |

| Selling Some Assets | ||||

| Borrowing Money | ||||

| Monthly payments | ||||

| Credit Counselling | ||||

| Consumer Proposal | ||||

| Bankruptcy | ||||

| Debt Settlement | ||||

| Do Nothing | ||||

| Wait & see approach |

This chart highlights the fact that there are few debt relief options available to a consumer who has secured debt. A consumer who were to file for personal bankruptcy or make a consumer proposal obtains no relief from his secured creditors! You are in a better position if you owe money to an unsecured consumer creditor—such as credit cards or utilities—than if you were to owe money to the government. A number of debt relief strategies, including credit counselling and negotiating a settlement involving a lump sum payment for less than the full amount owing, are not available if your creditor is the government. From a debtor’s perspective the best kind of debt to have is unsecured consumer debt. Typically, secured debt would be the least attractive debt to owe and government debt would usually fall somewhere in the middle. Am I precluded from using any debt relief options? A number of debt relief options—particularly credit counselling, a consumer proposal, and bankruptcy–are not available to everyone who is experiencing financial difficulties. There are certain conditions which must be satisfied before a person can use these debt relief options.

Factors Which Might Preclude a Consumer From Using a Debt Relief Option

| Debt Relief Option | Conditions For Using this Debt Relief Option |

| Credit Counselling | Likely not available where a consumer has significant assets such as equity in a house.If a consumer enters into a Debt Management Plan with a credit counselling agency then each and every one of their unsecured consumer debts mus tbe included in the Plan without exception. |

| Consumer Proposal | Not available if the consumer’s total unsecured consumer debt is less than $10,000 Consumer must meet the definition of “insolvency” Under the federal Bankruptcy Act |

| Bankruptcy | Consumer must meet the definition of “insolvency” under the federal Bankruptcy Act |

| Debt Settlement | No guarantee that a creditor will agree to accept a discounted one-time payment as settlement in full.As a general rule creditors will not entertain potential settlements unless a debt is at least six months old. |

A significant percentage of people experiencing financial difficulties who see a Licensed Insolvency Trustee to explore personal bankruptcy or a consumer proposal find these debt relief options are not available because they are not “insolvent” as defined under the federal Bankruptcy Act. Under the Act a person is “insolvent” if they satisfy two conditions (1) he cannot pay his financial obligations as they become due, and (2) the dollar amount of their total debts exceeds the dollar amount of their total assets. A number of people experiencing financial difficulties fail to satisfy the second condition because if they were to sell their home they could use the proceeds to pay all their creditors. What are the disadvantages of each debt relief option? Each of the nine debt relief options will have one or more disadvantages. Depending upon your particular circumstances, one or more disadvantage of a specific debt relief option might be so unattractive as to remove it from the top of your list of preferred options.

Disadvantages of Various Debt Relief Options

| Debt Relief Options | Disadvantages |

| Selling some assets | Might be negative tax consequences Might be preferable to file for personal bankruptcy than cashing in RRSPs to raise money to pay debts because a bankrupt is entitled to keep their RRSPs in a bankruptcy excluding contributions made within 12 months of bankruptcy |

| Borrowing money | Might not make sense to borrow money at a higher interest rate in order to eliminate debts Borrowing money from family or friends might harm your relationship. |

| Monthly payments | Consumer might continue to receive collection calls and be sued Interest will continue to accrue on some, or all, of a debtor’s overdue accounts |

| Credit counselling | A very expensive option for eliminating unsecured consumer debt compared with a consumer proposal or debt settlement.Consumer must include all of his unsecured consumer debt in a Debt Management Plan with a credit counselling agency—including employer loans and debts where the statute of limitation has expired. Enrollment in a Debt Management Plan with a credit counselling agency deprives the consumer the potential opportunity to avoid paying his unsecured consumer debt due to the expiry of a limitation period. This option cannot be used to eliminate government debt including student loans. This option is much less flexible than debt settlement. |

| Consumer Proposal | A consumer proposal is not ideal for a consumer who does not have a regular source of income. A consumer proposal will be annulled if the consumer is more than three months in arrears making their monthly payments under his consumer proposal(a consumer proposal may be as long as five years). Approximately 25 percent of persons who make a consumer proposal are unable to complete it and virtually all of these people file for personal bankruptcy. A consumer must include all of their unsecured consumer debts in a consumer proposal. Making a consumer proposal deprives the consumer of the opportunity to avoid paying his unsecured consumer debt due to one of the following:

A consumer is not allowed to have credit during the period they are completing their consumer proposal—a period not to exceed five years. |

| Bankruptcy | In a bankruptcy the bankrupt is required to transfer all of their property to the Licensed Insolvency Trustee except for that property which is exempt under federal or provincial law.

This option is much less flexible than debt settlement |

| Debt Settlement | A consumer will typically have to wait a minimum of six months before a creditor might entertain a potential settlement. A consumer who has not resolved an outstanding account should expect to receive collection calls and face the possibility of lawsuits brought by creditors.This option cannot be used to eliminate government debt including student loans. Interest will continue to accrue on some, or all, of a debtor’s overdue accounts. The fact that a consumer is not paying an unsecured consumer debt (i) will likely result in collection calls, (ii) might result in a lawsuit, and (iii) might result in collection calls and litigation involving a co-signor. |

| Do Nothing | Interest will continue to accrue on some, or all, of a debtor’s overdue accounts. The fact that a consumer is not paying an unsecured consumer debt (i) will likely result in collection calls, (ii) might result in a lawsuit, and (iii) might result in collection calls and litigation involving a co-signor. |

| Wait-and-see approach | Interest will continue to accrue on some, or all, of a debtor’s overdue accounts. The fact that a consumer is not paying an unsecured consumer debt (i) will likely result in collection calls, (ii) might result in a lawsuit, and (iii) might result in collection calls and litigation involving a co-signor. |

What are the advantages of each debt relief option?

The following chart summarizes the advantages of each consumers’ nine debt relief options.

Advantages of Various Debt Relief Options

| Debt Relief Option | Advantages of this Debt Relief Option |

| Selling some assets | This strategy might provide the funds to enable a consumer to make payment in full or settle their debts at a huge discount.A consumer experiencing financial distress might benefit from the sale of their home:

|

| Borrowing money | This strategy might provide the funds to enable a consumer to make payment in full or settle their debts at a huge discount.If a consumer can borrow money from friends or family he might be able to eliminate his unsecured consumer debt by making a one-time payment equal to approximately 35 percent of their total unsecured debt (unsecured consumer debt and government debt) using a consumer proposal. |

| Monthly payments | An unsecured creditor, and their authorized collection agent, will accept monthly payments from debtors and this might deter a creditor from suing debtor.Making monthly payments can be used to pay down monies owing to the government where consumer is not going to be making a consumer proposal or filing for bankruptcy. This option provides the consumer with maximum flexibility in terms of (1) when and how much monies are paid to creditors, and (2) which creditors are to be paid. |

| Credit counselling | This option permits a consumer to reduce the amount of money they are currently paying each month to their unsecured consumer creditors.This option will result in the end of all collection activity by unsecured consumer creditors. |

| Consumer proposal | This option puts a consumer in a position, subject to successful completion of the consumer proposal, to eliminate both (1) unsecured consumer debt, and (2)monies owing to the government for approximate to 40 cents on the dollar, over a period not to exceed five years.A consumer will be able to retain the equity in their home—something he might not be able to do in a bankruptcy. A consumer will not have to make surplus income payments, something which those earning more than $30,000 a year must do who file for bankruptcy. Interest will stop accruing on debt included in a Consumer proposal. This option will result in the end of all collection activity by unsecured consumer creditors. As soon as your consumer proposal is filed then all civil suits against you are stayed or suspended, except for child support and spousal support. Terminates any wage garnishments other than for support payments. If you make a consumer proposal you will be required to pay approximately 65 percent of your outstanding student loans. If you file for personal bankruptcy less than seven years after you cease attending school then none of your student loan indebtedness will be discharged in a bankruptcy. |

| Bankruptcy | In a bankruptcy the bankrupt is entitled to keep their RRSPs except for contributions made 12 months prior to bankruptcy.As long as the bankrupt ceased attending school more than seven years before bankruptcy then bankrupt will be able to obtain forgiveness of student loan indebtedness. As soon as you file for bankruptcy then all civil suits against you are stayed, except for child support and spousal support. Terminates any wage garnishments other than for support payments. Once a bankrupt is discharged then all of their unsecured debt is forgiven. A discharged bankrupt is entitled to have credit. This option will result in the end of all collection activity by unsecured consumer creditors. |

| Debt Settlement | A consumer who has not been sued might be able to eliminate their unsecured consumer debt at huge discounts.A consumer has maximum flexibility in terms of which debts he wants to (i) pay in full (ii) resolve by way of discounted settlement (iii) decline to make any payments whatsoever A consumer can choose to stop making payments on virtually all of his credit cards and lines of credit but continue to make payments on one in order to have access to some credit. |

| Do Nothing | Can be an excellent strategy for those with unsecured consumer debt (1) who have not been sued, or are(2) judgment proof or virtually judgment proof.A consumer might never be sued on an unsecured consumer debt. In the event that a consumer is successfully sued on an unsecured consumer debt the creditor might never recover a penny from the consumer. Once an outstanding unsecured consumer debt reaches a certain age then the relevant limitation period will expire, and as a practical matter the creditor will have tremendous difficulty collecting the account. |

| Wait-and-see approach | Can be an excellent strategy for those with unsecured consumer debt who have not been sued. It leaves open the possibility that a consumer can avoid paying their unsecured consumer debts due to the expiry of a limitation period.If a consumer is sued before the expiry of the relevant limitation period he still has several options available. This option provides the consumer with significant flexibility. |

What are the ideal circumstances for using a particular debt relief option?

How much will it cost you to eliminate a dollar in debt using each of a consumers’ nine debt relief?

| Debt Relief Option | Cost of Eliminating a Dollar of Your Debt |

| More than $1.20 | Consumers who choose to eliminate their debt, regardless of which type, by borrowing money at high rates of interest might spend more than $1.20 to eliminate a $1.00 of their debt. |

| $1.00 to $1.20 | Consumers who(1) borrow money for less than 20 percent interest,(2) enroll in a Debt Management Plan with a credit counselling agency will eliminate a $1.00 of their unsecured consumer debt for somewhere between a $1.00 and $1.20 |

| Approximately $1.00 | Secured debt: As a general rule, a consumer is going to pay $1.00, plus interest and penalties, to eliminate $1.00 of secured debt.Government debt: A consumer is going to pay $1.00 to eliminate a $1.00 in debt owing to the government, plus penalties and interest, unless they (1) make a consumer proposal or (2) file for personal bankruptcy in circumstances where student loans are discharged?those where the bankrupt ceased attending school more than seven years ago. |

| $0.40 to $0.99 | Consumers who negotiate lump sum settlements with their unsecured consumer creditors might pay between $0.40 and $0.99 to eliminate a $1.00 in debt. Settlements are usually much less generous to consumers in circumstances where a consumer has been sued. |

| $0.30 to $0.40 | In a consumer proposal it is common for consumers to pay an amount equal to 30 to 40 percent of their total unsecured indebtedness (including monies owing to the government), by making monthly payments over a period not to exceed five years.It is possible that it might cost a person who files for personal bankruptcy who (i) is a high-income earner, or (ii) has to transfer a significant amount of non-exempt assets to a Licensed Insolvency Trustee somewhere between $0.30 and $0.40 to eliminate a dollar of debt. Consumers who negotiate lump sum settlements with their unsecured consumer creditors might pay between $0.30 and $0.40 to eliminate a $1.00 in debt. |

| $0.01 to $0.30 | Persons who file for personal bankruptcy and who either (i) earn more than $35,000 per year, or (ii) have to transfer non-exempt assets to the Licensed Insolvency Trustee may effectively pay somewhere between $0.01 and$0.30 to eliminate a dollar in debt.In some circumstances a consumer might be able to negotiate a lump sum settlement for an unsecured consumer debt by making a lump sum settlement equal to$0.20 to $0.30 on the dollar. While not common, there have been cases where a consumer was able to eliminate their debt under a consumer proposal for an amount between $0.20 and $0.30. |

| Close to $0.00 | If you file for personal bankruptcy in circumstances where you do not have to make any surplus income payments, nor do you have to surrender any assets to the Licensed Insolvency Trustee, then other than the $1,600 fee the consumer pays to the Licensed Insolvency Trustee then the consumer has eliminated their unsecured consumer debt and monies owing to the government for close to zero.It is important to remember that student loans are not discharged in a bankruptcy unless the bankrupt ceased to attend school at least seven years prior to the bankruptcy |

| $0.00 | If you stop making payments to an unsecured consumer creditor under one of the following circumstances: your creditor does not sue you the relevant limitation period expires despite the fact that your creditor successfully sues you they are unable to enforce their judgment and recover any monies from you. |

The goal of the following chart is to identify those circumstances where it might be ideal to use a particular debt relief option.

Circumstances Where a Specific Debt Relief Option Might Be Ideal

| Debt Relief Option | Circumstances Where This Option Might Be Ideal |

| Selling some assets | Selling any real estate you own in your own name might be very helpful, raising additional cash and potentially reducing the likelihood that you might be sued. |

| Borrowing Money | Where you are not in dire financial straits and you can eliminate your debt by borrowing money in circumstances where the cost of borrowing money is inexpensive(monies sourced from a second mortgage or friends and family).If you are able to borrow some money from friend sand/or family members you might be able to eliminate your existing unsecured debts (including monies owing to the government) under a consumer proposal by making a lump sum payment equal to approximately 30 to 40 percent of your indebtedness. |

| Monthly payments | Where you do not want to resolve your unsecured consumer debt by making a consumer proposal or personal bankruptcy and you want to make attempts,over time, to reduce the amount of money that you owe to the government. |

| Credit Counselling | A strategy for eliminating unsecured consumer debt

|

| Consumer Proposal | A strategy for eliminating more than $10,000 in debt (unsecured consumer debt and government debt ) in circumstances where no other options are attractive.In some circumstances where a consumer has a significant amount of equity in their home and they have been sued by a creditor because the filing of a consumer proposal stays civil lawsuits against a consumer. A strategy for eliminating outstanding student loans at approximately 35 cents on the dollar in circumstances where the consumer ceased attending school less than seven years ago. |

| Bankruptcy | Where the consumer has unsecured consumer debt – and potentially government debt in circumstances where

|

| Debt Settlement | A strategy for eliminating unsecured consumer debt where a consumer has yet-to-be sued and neither a consumer proposal nor bankruptcy are an attractive option.Might be helpful if consumer has a large loan with an employer. |

| Do Nothing | A strategy for eliminating unsecured consumer debt where

|

| Wait-and-see approach | A strategy for eliminating unsecured consumer debt where you have not been sued on most, or all, of your unsecured consumer debt. |

Are there any reasons why I might want to wait before I choose a particular option?

There are a number of scenarios where it might be in your best interests to wait before you employ a particular debt relief option: Eliminating your student loans: It is possible to eliminate your student loans as long as you file for bankruptcy seven years after you ceased attending school. If you file for personal bankruptcy before this seven year period then your student loans will not be discharged in your bankruptcy. If your goal is to eliminate your student loans in a bankruptcy then it is crucial that you wait until seven years have elapsed after you cease attending school before filing for personal bankruptcy. Some consumers, while they wait for this seven year period to elapse, will enroll in a Debt Management Plan with a credit counselling agency, with the short-term goal of (1) lowering their monthly payments to unsecured consumer creditors, and (2) stopping collection calls from these creditors. Eliminating your unsecured consumer debt: You might be able to avoid paying a penny to one or more of your unsecured creditors without going bankrupt. This can happen in any one of the following scenarios provided you stop making payments to your unsecured creditors (credit cards, personal loans, utilities, et cetera) unless you have already stopped making payments:

- Your creditor(s) do not sue you

- The limitation period on your unsecured consumer debt expires

- Despite the fact that your creditor successfully sues you it is unable to successfully enforce its judgment and recover any monies from you

If you have unsecured consumer debt you might want to stop making payments to these creditors and then wait to see which of your unsecured creditors, if any, sue you before you consider making a consumer proposal or filing for personal bankruptcy. Once you stop making payments to some unsecured creditors you might be in a position to build a war chest used to fund future lump sum settlements with creditors. You can potentially negotiate settlements with your unsecured creditors for less than one hundred percent of the outstanding balance–sometimes for as little as twenty-five cents on the dollar. Your creditor, however, will typically be much less generous negotiating a settlement after going to the time, trouble and expense of suing you, in which case they might consider settling for a lump sum payment equal to eighty-five percent of the outstanding balance. If your wait-and-see approach does not work then you can always use a consumer proposal or personal bankruptcy as your fall-back position.

If you have unsecured consumer debt you might want to stop making payments to these creditors and then wait to see which of your unsecured creditors, if any, sue you before you consider making a consumer proposal or filing for personal bankruptcy. Once you stop making payments to some unsecured creditors you might be in a position to build a war chest used to fund future lump sum settlements with creditors. You can potentially negotiate settlements with your unsecured creditors for less than one hundred percent of the outstanding balance–sometimes for as little as twenty-five cents on the dollar. Your creditor, however, will typically be much less generous negotiating a settlement after going to the time, trouble and expense of suing you, in which case they might consider settling for a lump sum payment equal to eighty-five percent of the outstanding balance. If your wait-and-see approach does not work then you can always use a consumer proposal or personal bankruptcy as your fall-back position.

To learn more about a consumer proposal or personal bankruptcy you might want to meet with a Licensed Insolvency Trustee.